PrimeXBT Trading Fees

PrimeXBT is a widely used trading platform that offers a range of financial instruments, including cryptocurrencies, forex, commodities, and indices. Understanding the fee structure on PrimeXBT is crucial for traders aiming to optimize their strategies and manage costs effectively. This article will provide an in-depth look at PrimeXBT trading fees, detailing how they are calculated, the different types of fees, and strategies to minimize them.

Introduction to PrimeXBT Trading Fees

PrimeXBT trading fees are primarily composed of maker and taker fees, which are charged when executing trades on the platform. These fees are a critical component of the overall cost of trading and can impact your profitability significantly. By understanding these fees in detail, you can make more informed trading decisions and enhance your financial outcomes.

Maker fees are charged when you add liquidity to the market by placing limit orders that are not immediately filled. Taker fees, on the other hand, are charged when you remove liquidity from the market by placing market orders that are executed immediately. PrimeXBT’s fee structure is designed to encourage liquidity provision, offering lower fees for makers.

- Maker Fees: Charged for adding liquidity to the order book by placing limit orders.

- Taker Fees: Charged for removing liquidity from the order book by placing market orders.

- Fee Rates: Vary based on the asset being traded and can change according to market conditions.

- Volume Discounts: Higher trading volumes can qualify for reduced fees.

- Example Calculation: If the maker fee is 0.05% and the taker fee is 0.075%, a $10,000 trade would incur $5 for a maker order and $7.50 for a taker order.

Understanding these basic concepts is the first step towards mastering PrimeXBT’s fee structure. In the following sections, we will delve deeper into the specifics of these fees and how they impact different types of trades.

Next, we will explore the detailed breakdown of maker and taker fees on PrimeXBT.

Detailed Breakdown of Maker and Taker Fees

Maker and taker fees are a fundamental part of trading on PrimeXBT. The platform charges these fees to incentivize traders to add liquidity to the market. By understanding how these fees work, traders can better manage their costs and optimize their trading strategies.

Maker fees are generally lower than taker fees. This is because maker orders contribute to market liquidity by adding limit orders to the order book. Taker orders, conversely, remove liquidity by executing against existing orders. The difference in fees reflects the platform’s aim to maintain a liquid and efficient trading environment.

- Maker Fee Example: A maker fee of 0.05% on a $10,000 limit order results in a fee of $5.

- Taker Fee Example: A taker fee of 0.075% on a $10,000 market order results in a fee of $7.50.

- Fee Calculation: Calculated as a percentage of the trade value, maker and taker fees are straightforward to compute.

- Impact on Trading: Lower maker fees can encourage traders to place limit orders, enhancing market liquidity.

- Strategic Considerations: Traders can reduce costs by choosing the appropriate order types based on their strategy.

By understanding these fees and how they are applied, traders can make more informed decisions about their order types and trading strategies. This knowledge can lead to significant cost savings, especially for high-frequency traders.

Now, let’s examine the impact of trading volume on PrimeXBT trading fees.

Impact of Trading Volume on Fees

PrimeXBT offers volume-based discounts on trading fees to incentivize higher trading activity. These discounts can be substantial for traders with high trading volumes, reducing the overall cost of trading on the platform. Understanding how these volume discounts work can help traders maximize their savings.

The fee structure on PrimeXBT is designed to reward active traders. As your trading volume increases, you become eligible for lower fee rates. This tiered fee structure encourages traders to increase their activity on the platform, contributing to greater market liquidity and efficiency.

- Volume Tiers: PrimeXBT has multiple volume tiers, each offering progressively lower fees.

- Eligibility: Higher trading volumes qualify for reduced fee rates, making active trading more cost-effective.

- Calculation Period: Trading volume is typically calculated over a 30-day period to determine the applicable fee tier.

- Example: A trader with a monthly trading volume of $1 million may receive a discount, lowering the maker fee to 0.04% and the taker fee to 0.07%.

- Strategic Benefits: By increasing trading activity, traders can significantly reduce their fee burden.

Understanding and leveraging these volume discounts is essential for traders looking to minimize their costs. By planning your trades to maximize volume, you can take full advantage of the lower fee rates offered by PrimeXBT.

Next, we will look at the different types of assets and their specific fee structures on PrimeXBT.

Asset-Specific Fee Structures

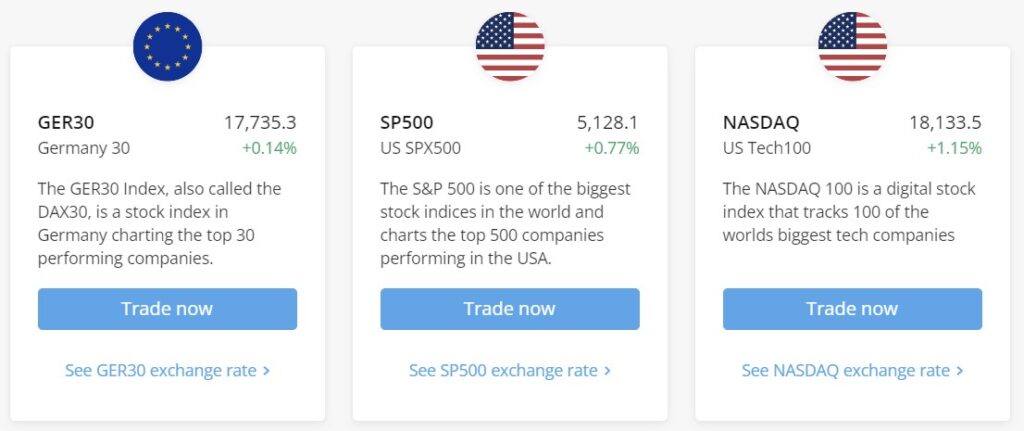

PrimeXBT offers trading across a variety of asset classes, including cryptocurrencies, forex, commodities, and indices. Each asset class has its own fee structure, reflecting the different market conditions and risk profiles associated with each type of asset. Understanding these asset-specific fee structures is important for effective cost management.

Cryptocurrencies, for example, tend to have higher fees compared to traditional assets like forex or commodities. This is due to the higher volatility and risk associated with digital assets. Forex trading, on the other hand, generally incurs lower fees, making it an attractive option for cost-conscious traders.

- Cryptocurrencies: Higher fees due to increased volatility and risk.

- Forex: Generally lower fees, reflecting the stable and liquid nature of currency markets.

- Commodities: Fee structures vary based on the specific commodity and market conditions.

- Indices: Fees depend on the composition and volatility of the index being traded.

- Example Comparison: Trading Bitcoin might incur a taker fee of 0.1%, while trading EUR/USD could have a taker fee of 0.05%.

By choosing the right asset classes based on their fee structures, traders can optimize their trading costs. It’s important to consider not only the potential returns but also the associated costs when selecting assets to trade.

We will now summarize the key points about PrimeXBT trading fees in a table format for easy reference.

Summary of PrimeXBT Trading Fees

| Fee Type | Description | Rate |

|---|---|---|

| Maker Fees | Charged for adding liquidity with limit orders | 0.05% (example rate) |

| Taker Fees | Charged for removing liquidity with market orders | 0.075% (example rate) |

| Volume Discounts | Reduced fees based on trading volume | Varies by volume tier |

| Asset-Specific Fees | Different rates for various asset classes | Varies by asset |

This table provides a quick reference to the key types of trading fees on PrimeXBT and their typical rates. Understanding these fees is essential for effective cost management.